Get Ed Crooks' Energy Pulse in your inbox every week

Energy companies seek answers amid US tariff uncertainty

The Trump administration shifted policy rapidly on proposed 25% tariffs on Canada and Mexico

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Energy companies seek answers amid US tariff uncertainty

-

Opinion

The growth of energy storage seems unstoppable

-

Opinion

Pressure builds on US energy tax credits

-

Opinion

The Trump administration remakes US environmental approvals

-

Opinion

What do President Trump’s tariffs mean for energy?

-

Opinion

US tariff announcements add to uncertainty

In ‘Alice’s Adventures in Wonderland’, Alice complains to the Caterpillar: “I know who I was when I got up this morning, but I think I must have been changed several times since then.” US tariff policy feels quite like that at the moment.

The rapid evolution of US import tariffs over the past six weeks has made it difficult to assess their impact. Announced tariffs have been changing day by day, sometimes hour by hour. The one certainty is uncertainty, lasting for an uncertain length of time.

Businesses in every sector are taking steps to manage this policy instability, including examining their supply chains, scrutinising contracts, optimising inventories and drawing up contingency plans for responding to future changes. In the energy industry, there is additional volatility created by the impacts on commodity prices.

Since President Donald Trump’s inauguration on 20 January, US benchmark West Texas Intermediate crude has dropped from about US$78 a barrel to about US$66 a barrel, a decline of about 15%. Uncertainty over the economic outlook is certainly not the only reason (more on this below) but it is a contributory factor.

This week’s twists and turns in the tariff saga involved Canada and Mexico. Last month, President Trump announced new 25% tariffs on imports from those two countries, with a lower 10% rate on energy from Canada, and then paused implementation for a month.

This week, the administration said those tariffs would take effect on 4 March, but then announced another partial delay a day later. The new tariff structure now exempts goods that meet the rules of origin test under the US-Mexico-Canada Agreement (USMCA), the trade deal signed by President Trump in 2020 to replace the North America Free Trade Agreement (NAFTA).

The rules of origin define the standards for domestic content that goods need to meet to qualify as “originating” in a country. The aim is to stop goods being imported into one USMCA country and then exported to another on favourable terms, when they are merely passing through. The details are complex, specific to each product and set out in hundreds of pages of the USMCA.

White House officials briefed that 50% of US imports from Mexico and 38% of imports from Canada meet the rules of origin standards, and so will be exempted from the new tariffs for the time being. Oil and gas are covered under the USMCA, as they were under NAFTA, so seem to be included in the exemptions.

However, even the exempted products have been granted only a temporary reprieve. The administration indicated that the new tariffs could still be imposed across the board, starting 2 April.

Meanwhile, the administration also doubled tariffs on imports from China this week. The rate was raised from the 10% announced last month to 20%.

Canada, Mexico and China have all announced retaliatory tariffs, often targeting US agricultural exports. Canada published a long list of US imports that will face new 25% tariffs. Some C$30 billion worth of imports were hit immediately, starting from 4 March. A further C$125 billion worth will be added if the new US tariffs are not lifted.

Some Canadian politicians have suggested more drastic measures. Doug Ford, premier of Ontario, said he would cut off electricity exports to the US if necessary, “with a smile on my face”, to persuade the Trump administration to back down. He announced that a 25% tariff would be imposed on those electricity exports, starting from Monday.

NYISO, which operates the gird for New York State, and Midcontinent ISO (MISO), which covers an area from Manitoba down to Louisiana, both trade power with Ontario, with the US being a net importer. On average, NYISO imports approximately 3% of its total electricity demand from Ontario, while MISO imports less than 1%.

Energy companies are grappling with the uncertainty not only over when the new tariffs will be applied, and to which products, but also over how they will be administered. In the power sector, at least two independent system operators have submitted filings to the Federal Energy Regulatory Commission, asking for clarification.

The Wood Mackenzie view

Wood Mackenzie analysts have been watching cross-border energy trade flows closely for any visible effects from the current and threatened tariffs. The impact appears to have been minimal so far.

The average price of US electricity imports from Ontario has fallen slightly since the tariffs took effect, but that seems to have been driven by market conditions, according to Rebekah Llamas, Wood Mackenzie’s head of market intelligence for power market research. Demand has been lower as temperatures have warmed up in the northeast US.

It has been a similar picture for gas. US imports from Canada have fallen, but only in line with what we would have expected given the milder weather.

Meanwhile, there has also been a reduced flow on some oil pipelines from Canada to the US. Wood Mackenzie analysts Dylan White and John Trischan say it is unclear whether the tariff threat has had any impact yet. And they expect the vast majority of Canada-to-US crude movements to persist even if a 10% tariff is imposed. But it will take time for optimal trade flows to be re-established as policies shift.

A key message from our consultants and researchers has been the need for companies to understand their supply chains in depth to help them navigate these turbulent conditions. The differentiated impact of the new tariffs, based on rules of origin, adds another layer of complexity.

Wood Mackenzie’s supply chain consulting team has drawn up a checklist of essential actions for companies to reduce their vulnerability to policy shocks and emerge stronger from this period of instability. The report says many companies will be facing a pivotal moment: “The next 30-60 days will separate proactive leaders from those forced into reaction as companies respond to tariff uncertainty.”

In brief

Oil prices continued to slide this week, with Brent crude trading at about US$70 a barrel on Friday morning, down from a high of over US$82 a barrel in January. The threat of a global trade war, with escalating tariffs leading to a sharp slowdown in growth, is weighing on the market. Prices also came under pressure following the confirmation from key members of the OPEC+ group of countries that they would go ahead with the gradual unwinding of some of their production cuts from next month.

President Trump has often talked about his intent to bring down oil prices, with the goal of reducing the cost of living for American consumers. Peter Navarro, President Trump’s senior counselor for trade and manufacturing, said getting oil prices down to US$50 a barrel would be enough to shave one percentage point from the inflation rate, allowing the Federal Reserve to resume cuts in interest rates.

The short-listed companies in Saudi Arabia’s latest solar power procurement round have put forward bids with a levelised cost of electricity (LCOE) ranging from just US$13 per megawatt hour to about US$19/MWh. Those prices are somewhat higher than the record low of US$10.40/MWh bid in an earlier Saudi round in 2021, but they still highlight the low cost of solar generation in some areas compared to other technologies such as gas or nuclear.

Other views

Majors' capital allocation in a stuttering energy transition – Simon Flowers and others

South America to add 160 GW of solar PV capacity by 2034

India needs US$4.3 billion government support to enable CCUS adoption

Britain is throwing too much green energy to the wind – Nathalie Thomas

A new suite of products from Wood Mackenzie

Lens Power and Renewables: helping you navigate the global energy market

Quote of the week

“Whether the US president wishes to admit it or not, the United States not only needs our oil and gas today, they are also going to need it more and more with each passing year, once they notice their declining domestic reserves and production are wholly insufficient to keep up with the energy demands of US consumers and industry. Let alone having anything left over to export, as they do today.”

Danielle Smith, premier of Alberta, said the oil and gas reserves of her province were Canada’s “secret weapon” in its trade conflict with the US. She later clarified her position, saying that the province would never consent to the Canadian federal government cutting off or imposing tariffs on Alberta’s oil and gas exports to the US. Retaliatory action of that kind would hurt Albertans and other Canadians far more than Americans, she said.

Chart of the week

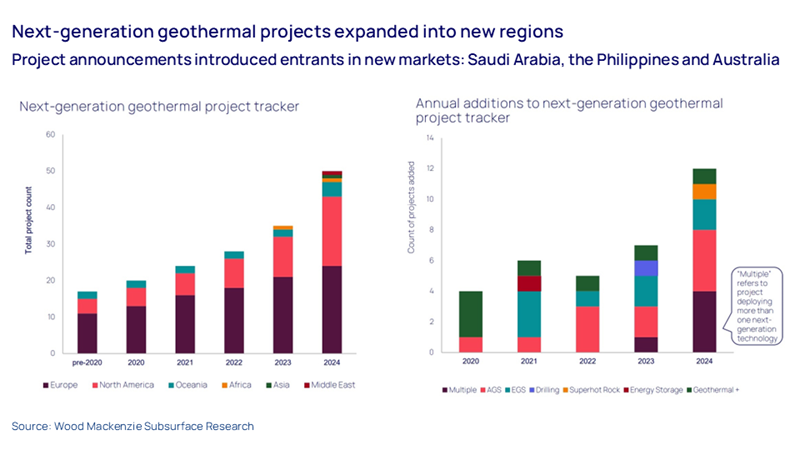

There has been a surge of interest in advanced geothermal energy: systems that employ the latest innovations in horizontal drilling, hydraulic fracturing and other technologies to achieve dramatic gains in performance and flexibility. As a clean, reliable source of 24/7 baseload power, geothermal energy is an excellent option for meeting growing electricity demand from data centres while helping users curb emissions and meet energy transition targets.

Kate Adie, Annick Adjei and Zoé Sulmont, analysts from Wood Mackenzie’s subsurface and energy transition teams, recently published an overview of the industry, highlighting some of the key developments of 2024. These charts show how next-generation geothermal has been gathering momentum, with the total number of active projects growing in most regions, and an acceleration in the number of new projects announced each year.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.