Get Ed Crooks' Energy Pulse in your inbox every week

President Trump's inflation fight could put pressure on oil

The administration aims to increase production and lower prices. The two goals may be difficult to reconcile

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What does financial market turmoil mean for low-carbon energy?

-

Opinion

President Trump's inflation fight could put pressure on oil

-

Opinion

Energy companies seek answers amid US tariff uncertainty

-

Opinion

The growth of energy storage seems unstoppable

-

Opinion

Pressure builds on US energy tax credits

-

Opinion

The Trump administration remakes US environmental approvals

Chris Wright, the US energy secretary, last week explained President Donald Trump’s economic priorities. “He got elected to lower prices for American consumers,” Wright told Bloomberg TV. “You think he’s going to change his mind and say ‘No, I’m in favor of higher prices on American consumers’? That’s not where this administration is going.”

Wright’s assessment, repeated several times during the week, clearly indicated a key goal of the administration’s strategy: reducing energy prices, including oil prices, to benefit US consumers.

The administration is working on a range of measures intended to boost oil production, including deregulation, accelerated permitting and more active leasing of federal lands and waters. Wright posted on X over the weekend: “Under President Trump’s leadership, we will DRILL, BABY, DRILL.” He added: “It’s simple: [Up] Energy supply = [Down] Energy prices”.

Much of what Wright said last week will have been very welcome in the oil and gas industry. He criticised the Biden administration’s “irrational, quasi-religious” climate policies, emphasised the growing role for natural gas, including in power generation for data centres, and pledged to expedite the development of new energy infrastructure such as pipelines.

But there is a looming contradiction in the Trump administration’s strategy. In an environment of falling oil prices, the industry will be less enthusiastic about increasing production. Even though the administration is broadly supportive of the oil industry, its policies could indicate a period of turbulence ahead.

The price of oil has already dropped significantly since President Trump’s inauguration in January. US benchmark West Texas Intermediate (WTI) crude was trading at about US$68 a barrel on Friday, down about 15% from its recent peak in mid-January.

In part, that has reflected concerns about the economic outlook, including fears about an escalating international trade war sparked by President Trump’s tariff increases. US shares bounced on Friday after Congress voted to avoid a government shutdown, but the S&P 500 is still down about 6% since the inauguration. There were also signs last week of a decline in consumer confidence.

Members of the Trump administration have made clear that they are happy to withstand some short-term turbulence, with the aim of putting the economy on a sounder footing for the long term. They hope to create the conditions for a rebound in time for the midterm elections in November 2026.

Howard Lutnick, the Commerce secretary, suggested last week that the benefits of the administration’s strategy would start to show by the end of the year. “We own the economy in the fourth quarter," he told Fox Business. “First and second quarter… we get a little bit of benefit from us, but it is the mess that we were left with."

President Trump himself has welcomed signs of falling prices, including oil prices. Last week he cited three signs that his policies were working: a fall in the wholesale price of eggs, a decline in long-term interest rates and a fall in the price of gasoline. The average retail price of gasoline in the US was about US$3.20 a gallon last week, down from US$3.28 a gallon in mid-February. The decline in crude prices means it is likely to fall further.

Declining inflation is central to the administration’s strategy. Its plan is that lower inflation will create scope for interest rates to fall, and that will stimulate private sector borrowing and investment. The US Federal Reserve’s Federal Open Market Committee is expected to leave interest rates unchanged at its meeting on Wednesday, following evidence that inflation is still running above the Fed’s 2% target. To make it possible for rates to be cut, there will need to be further downward pressure on prices. And that is likely to include the price of oil.

Wood Mackenzie view

Scott Bessent, the US Treasury secretary, suggested last year that the administration’s goal should be to increase US oil and gas production by 3 million barrels of oil equivalent per day by 2028. On Wood Mackenzie’s base case forecast, that goal should be achievable, supported by growth in gas production..

However, that base case forecast depended on our projected oil price. With lower prices, that production growth does not materialise. “A prolonged US$50 a barrel price [for WTI] would result in immediate production declines,” Wood Mackenzie analysts wrote.

Chris Wright has argued that production growth will still be possible with US$50 oil because costs will be lower. He has drawn an analogy to 2014-16, when WTI dropped from over US$105 a barrel to below US$30. “There was a lot of disruption, but the end result was far lower costs to produce a barrel of oil,” he told the Financial Times. “We are going to see those same kind of market dynamics now.”

It is true that costs fell during the oil price decline of 2014-16, and production growth then resumed, but it took a while. US crude production started falling in May 2015, and did not start recovering until nearly 18 months later.

The administration’s policies are intended to help drive production costs lower, accelerating that process of adjustment. Lee Zeldin, administrator of the Environmental Protection Agency, last week announced what he called the “biggest deregulatory action in US history”, which included several measures aimed at easing restrictions on the oil and gas industry.

Wood Mackenzie analysts have generally taken a cautious view on the speed and scale of any positive impact from those measures. Most of those EPA actions will take time to work through and, in general, are expected to have only a marginal impact on production costs.

We wrote last month, following the first round of executive orders from President Trump: “Large E&Ps and Majors haven’t laid out any change in their drilling plans for 2025. Small producers and privates might increase drilling activity, but we will wait to see concrete evidence before adjusting our supply model.”

Since then, there have been further announcements of tariffs, including the end of exemptions from the 25% levy on imported steel. This will put upward pressure on oil and gas costs and make it harder to accelerate production growth.

Ryan Duman, a director on Wood Mackenzie's US Upstream Research team, says the analogy with 2014-16 may not fully hold. Companies will keep prioritising distributions to shareholders, regardless of how prices and costs evolve.

“A key difference in the 2016 recovery is that companies then were still outspending cash flow. Today they have much lower reinvestment rates and more robust dividend policies,” he says. “Also, type well costs to develop fields are down massively in tight oil, and I am not sure they can drop again on the same absolute scale. Over 2014-18, those unit costs fell from roughly US$20 per barrel of oil equivalent to below US$10. They can get better, but it's not linear. US$10 can't go to zero.”

The Trump administration has been moving fast in its first eight weeks, launching a barrage of policy initiatives because it has a long list of objectives it wants to achieve. Its energy and economic policies may reveal areas where some of those objectives are in conflict.

In brief

Mark Carney, who was sworn in as Canada’s new prime minister on Friday, announced the end of the country’s consumer carbon tax as his first act in office. Carney said that although his government would still be committed to tackling climate change, scrapping the tax would “make a difference to hard-pressed Canadians”. He had previously described the tax as “too divisive”.

The tax had been designed to generate cash for rebates paid out to consumers in a bid to make it more popular, but support appeared to have been waning. A poll in January found that 64% of respondents were strongly or somewhat in favour of suspending the tax, while only 19% were against it.

The US Export-Import Bank has approved a US$4.7 billion loan for TotalEnergies’ Mozambique LNG project.

Breakthrough Energy, the climate and energy initiative backed by Bill Gates, has reportedly cut dozens of jobs as it refocuses its efforts. The group said in a statement that Gates remained “as committed as ever to advancing the clean energy innovations needed to address climate change”. His work would remain focused on “helping drive reliable, affordable, clean energy solutions that will enable people everywhere to thrive,” the group added.

Other views

Solar surge: the US solar industry shatters records in 2024 – Zoë Gaston and Sylvia Leyva Martinez

Tracking distributed solar and storage competitive landscapes in 2024 – Max Issokson

The new grid defection: breaking down the large load co-location fight at FERC – Ben Hertz-Shargel

Adnoc chief Sultan al-Jaber: ‘It’s time to make energy great again’ – Malcolm Moore

Why America struggles to build – Brian Deese

California isn't clearing forests fast enough to tame wildfires – James Dinneen

Quote of the week

“New sources cannot even meet the growth in demand, while the proven sources needed to fill the gap are demonized and discarded. It is a fast-track to dystopia, not utopia. In short, the net result of 10 trillion dollars over 2 decades is to basically stand still and consume record quantities of coal. Not exactly mission accomplished! In fact, there is more chance of Elvis speaking next than the current plan working! And a wave of public dissatisfaction with transition reality is crashing over countries, companies, and consumers alike.”

Amin Nasser, CEO of Saudi Aramco, argued that attempts to rely on “immature” renewables had been self-destructive, and the world urgently needed a new model for the future of energy.

Chart of the week

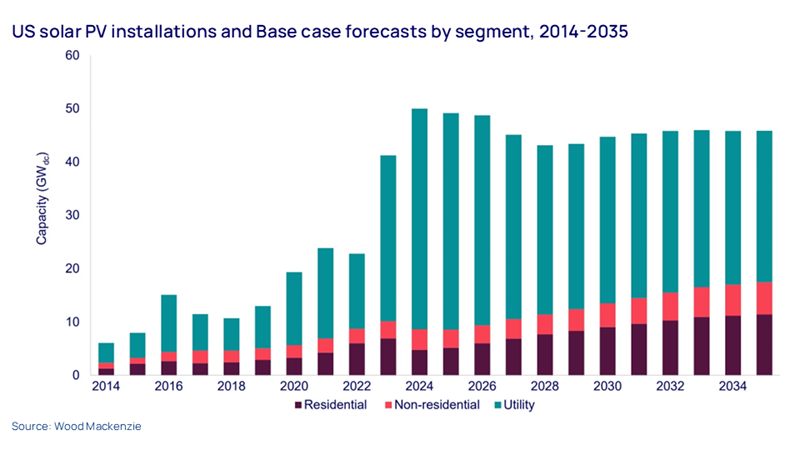

This chart shows US solar photovoltaic installations, actual numbers since 2014 and forecasts out to 2034. It comes from the new US Solar Market Insight 2024 Year in Review report, published by the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

You can see that we are now expecting annual installations to level off after dramatic growth in the past two years. The US installed a record-breaking 50 gigawatts (GW) of new solar capacity in 2024, the largest single year of new capacity added to the US grid by any energy technology in over two decades. Download the full report for a wealth of additional detail.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.