Get Ed Crooks' Energy Pulse in your inbox every week

Pressure builds on US energy tax credits

Incentives for renewables, storage and EVs in the spotlight as Congress looks for savings

9 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

How do we adapt to a warming world?

-

Opinion

What the conflict between Israel and Iran means for energy

-

Opinion

Geothermal, dealmaking, and the future of clean energy finance

-

Opinion

Renewables in the US face a future without tax credits

-

Opinion

Energy and the ‘big beautiful bill’

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

In this new era for the US government, it has been the executive branch that has made most of the running in setting policy, with a fusillade of executive orders from the Trump administration. This week, the legislative branch took the lead, with the House of Representatives narrowly passing a budget bill that will have profound implications for US taxation and government spending.

The bill, passed on a 217-215 vote, has no immediate impact on the energy industry. The exact consequences for taxes and spending will emerge only after extensive wrangling in the House and Senate, which could take many months. But what it does do is draw an outline of the space where those details can be filled in.

For the energy industry, one of the key issues in the negotiations will be the fate of the tax credits for low-carbon energy that were expanded and extended by the 2022 Inflation Reduction Act (IRA). Although supporters of those credits still have a chance to make the case for why they should be retained, the bill passed by the House this week highlights the scale of the challenge they face.

The bill starts the process of budget negotiations by setting some headline numbers for spending and tax cuts, with House committees asked to find detailed plans for achieving those objectives. The biggest job has been given to the House Ways and Means Committee, which has been asked to come up with proposals for tax cuts that add no more than US$4.5 trillion to the US budget deficit over the period 2025-34.

That might sound like it gives the committee quite a lot of leeway. But in the context of President Donald Trump’s calls for tax cuts, their freedom to manoeuvre is strictly limited.

President Trump has called for a renewal of the measures in the Tax Cuts and Jobs Act of 2017, and that alone is estimated to add about US$4 trillion to the deficit over that period.

The president has also called for no tax on tips (estimated cost from US$100 billion to US$250 billion), no tax on Social Security benefits (estimated cost about U$1.5 trillion), no tax on overtime (a further US$1.5 trillion), increased deductions for state and local taxes (up to US$1.2 trillion) and a cut in the main corporate tax rate from 21% to 15% (about US$675 billion).

In that context, there will be enormous pressure on members of the House to find savings elsewhere, to help create space to achieve at least some of the president’s objectives while staying within that US$4.5 trillion limit.

The Congressional Budget Office’s latest estimate of the cost of the IRA tax credits for electric vehicles and low-carbon energy over 2025-34 is US$800 billion. As members of Congress are looking for savings, those tax credits are tempting targets.

Polling shows that the American public generally supports the credits. Last year, 18 House Republicans wrote to Speaker Mike Johnson, arguing that “prematurely repealing energy tax credits… would undermine private investments and stop development that is already ongoing”. Fourteen of those members have returned to the new Congress, and they could wield significant power in a House where the Republican majority is paper-thin. But the budget arithmetic is unyielding.

Businesses in solar, wind, storage and other low-carbon technologies need to be prepared for the possibility that the production and investment tax credits that have underpinned their growth prospects could be scrapped.

The Wood Mackenzie view

Last year, looking ahead to the prospect of a possible Trump administration and Republican-controlled Congress, many in the US energy industry took a sanguine view of the outlook for the IRA tax credits. Most of the investment supported by the IRA has been flowing into Republican-controlled states and districts, and industry leaders hoped that would incentivise politicians to keep the credits in place. Today the mood is rather different.

At the Intersolar and Energy Storage North America conference in San Diego this week, Wood Mackenzie analysts gave a presentation setting out our industry outlook. At that session, we polled the audience on their expectations for the production and investment tax credits for solar and storage. About 75% said they thought the credits would be both cut in value and phased out faster than was planned under the IRA.

Any assessment of the impact will be uncertain until we see exactly what has been decided. But last year Wood Mackenzie modelled a downside scenario to give a sense of how wind, solar and storage might be affected. That scenario reflected an accelerated phase-out for the production and investment tax credits, as well as other headwinds including increased tariffs on imported equipment and reduced regulatory support for new transmission infrastructure.

In that scenario, additions of new wind, solar and storage capacity average about 50 gigawatts per year to 2033. That is about 30% lower than the level we projected if the tax credits and support from regulators remained in place.

We are still working on our revised forecasts, but we will have a new base case soon. There will also be a new low case, reflecting a faster phase-out of the tax credits as well as other possible policy impacts, including higher tariffs and increased regulatory barriers.

But while the renewables and storage industries are facing a challenging policy environment, they have other advantages going for them. Utility-scale solar, in particular, is highly competitive against gas-fired generation on a levelised cost of electricity (LCOE) basis, especially as the cost of gas turbines rises.

Above all, renewables and storage are relatively quick to bring on line. Although US gas turbine manufacturing capacity is growing, a new project placing orders today will most likely not be able to enter operation until 2030 at the earliest.

At a time when tech companies are competing to establish their capabilities in artificial intelligence, and planned construction of new data centres is soaring, “time to power” is a critical factor for new generation. Whatever happens to the IRA credits, this advantage will continue to support some investment in renewables and storage.

“Solar and storage are primed to help meet growing demand in the next five years,” says Kaitlin Fung, a Wood Mackenzie research analyst for North America utility-scale solar. “They accounted for more than 80% of all the new power supply capacity added in the US last year, and account for more than 75% of the active projects in interconnection queues. They have an important role to play.”

In brief

BP launched its strategy reset, including an increase in oil and gas investment to about US$10 billion a year. Its previous plan had been to invest US$8.5 billion a year in oil and gas over 2025-27. The higher spending is expected to pay off in higher production. BP had been planning for a decline in output from about 2.36 million barrels of oil equivalent per day last year to about 2.2 million boe/d in 2030. It is now aiming for 2.3 million to 2.5 million boe/d in 2030.

Murray Auchincloss, chief executive, said: “We are reallocating capital to drive growth from our highest returning businesses.” He added: “We acknowledge performance has not been where we want it to be. And we are focused on relentlessly driving improvement.”

Elliott Investment Management, an activist investor with a stake of nearly 5% in BP, has been pushing for change.

In a move aligned with its new strategy of aiming for production growth, BP has finalised an agreement with the Iraqi government to redevelop the Kirkuk oilfields. The project is intended to boost reserves by over 3 boe, and includes a new 400-megawatt gas-fired power plant to utilise associated gas. BP's revenues from the project will be linked to increased production volumes, as well as to prices and costs.

The US reached a deal with Ukraine over its natural resources, to underline the Trump administration’s support for peace and reconstruction in the region. The two counties are jointly setting up a new Reconstruction Investment Fund, which will receive 50% of all revenues earned by the Ukrainian government from its energy and natural resources, including oil, gas and minerals. The fund will invest in projects in Ukraine in natural resources, infrastructure and other industries.

Meanwhile, the US has pledged to “maintain a long-term financial commitment to the development of a stable and economically prosperous Ukraine”. Wood Mackenzie analysts warned that Ukraine’s resource potential in minerals was often exaggerated. When the resources are present, it could take seven years or more to bring new mines into production at scale. Significant income from increased minerals output is unlikely to flow until after President Trump has left office.

US dependence on imported copper is a threat to national security, President Trump said, as he announced an investigation of the market that could result in new tariffs. The president posted on his Truth Social platform: “American Industries depend on Copper, and it should be MADE IN AMERICA - No exemptions, no exceptions!”. The share of the US copper market that is supplied by imports has risen from virtually nothing in 1991 to about 45% last year, the White House said.

Mark Christie, chairman of the Federal Energy Regulatory Commission, has published a letter to officials in the Trump administration, detailing the commission’s significant actions last week. The letter follows President Trump’s executive order tightening the administration’s control of FERC and other independent government agencies.

Many of the actions listed by Christie reflect President Trump’s policy priorities, including authorising Venture Global Plaquemines LNG to increase its liquefaction capacity, granting Port Arthur LNG permission to install a feed gas pipeline, and arguing in court against the Sierra Club over a pipeline project to export US gas to Mexico.

Other views

Energy transition outlook: Americas – David Brown

Global economy: can momentum trump uncertainty? – Peter Martin

Oil market uncertainty could significantly affect prices

Quote of the week

“Too many people have been negatively biased towards the carbon economy without acknowledging that the carbon economy plays a very important role from an energy security perspective… A lot of focus has been on how does one constrain or constrict the carbon economy rather than on how one can grow or facilitate the new world energy economy... If the world spent more time focusing on that side of the equation [growing low-carbon energy], I think the transition will happen faster and capital will flow more easily.”

Julian Wentzel, chief sustainability officer at HSBC, argued in an interview with Bloomberg that it was time to end the negative bias against fossil fuels.

Chart of the week

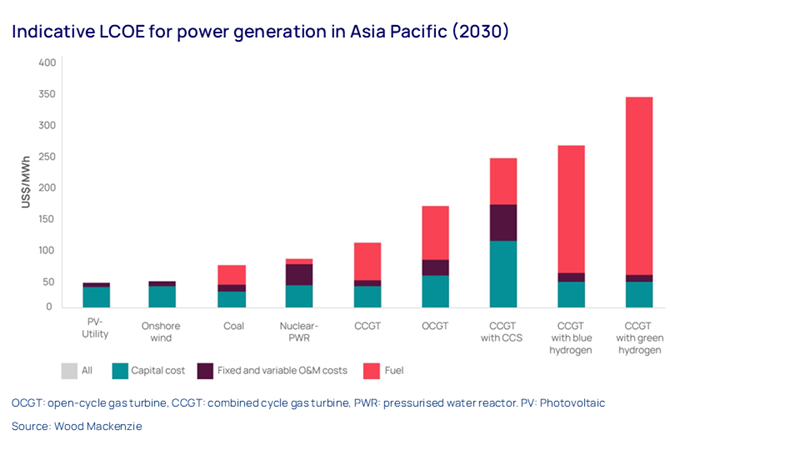

This is another great chart from the Horizons report on the future of natural gas that I mentioned last week. The report, The bridge: Natural gas's crucial role as a transitional energy source, argues that as energy demand grows around the world, gas and LNG will be critical in the shift to a lower-carbon future. But it still faces a number of challenges.

In the key growth markets of Asia, affordability is LNG’s biggest weakness. As this chart shows, LNG is expected to remain among the highest-cost options for Asian power generators: often more expensive than renewables, coal and even nuclear power.