Get Ed Crooks' Energy Pulse in your inbox every week

US tariff announcements add to uncertainty

Plan for reciprocal tariffs on US trading partners raises the possibility of steep increases

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

How do we adapt to a warming world?

-

Opinion

What the conflict between Israel and Iran means for energy

-

Opinion

Geothermal, dealmaking, and the future of clean energy finance

-

Opinion

Renewables in the US face a future without tax credits

-

Opinion

Energy and the ‘big beautiful bill’

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

“The great danger to the consumer is the monopoly, whether private or governmental,” argued the economist Milton Friedman. “His most effective protection is free competition at home and free trade throughout the world.”

For decades, that viewpoint seemed to be making ground in the US, on a bipartisan basis. President George HW Bush signed the North American Free Trade Agreement. President Bill Clinton supported China’s entry into the World Trade Organization. But over the past decade, since the start of the first Trump administration, the bipartisan consensus in the US has been shifting against free trade, and towards the use of tariffs to support domestic manufacturing.

In his second term, President Donald Trump has pushed the argument even further, announcing a barrage of new import tariffs in his first four weeks in office. Some have already taken effect. Others are looming and could be imposed very soon. Energy companies, along with every other industry, have been grappling with the implications for their supply chains.

Just in the past week, President Trump announced two measures that will have significant impacts. He imposed across-the-board 25% tariffs on imported steel and aluminium, removing exemptions from existing steel tariffs and raising the rate on aluminium from 10%. And he proclaimed a new comprehensive tariff strategy, which the administration said would aim to “correct longstanding imbalances in international trade and ensure fairness across the board”.

President Trump said on Thursday that the principle of the strategy would be reciprocal tariffs: “Whatever countries charge the United States of America, we will charge them. No more, no less.”

The White House memo made clear that this would apply not only to tariffs, but also to non-tariff barriers to US exports, such as food safety regulations. Other charges such as the digital service taxes levied by Canada and France and value-added taxes would also be included (more on the latter below).

The details are yet to be clarified. Administration officials have started work on studies of countries that trade with the US, and aim to deliver their analysis by 1 April. But it is clear already that the strategy, known as the “fair and reciprocal plan”, could result in greatly increased tariffs.

To take one example highlighted by the White House, Brazil charges a tariff of 18% on its ethanol imports from the US. But the US currently charges just 2.5% on its ethanol imports from Brazil. Whether US tariffs are raised or Brazilian tariffs are cut, or both, that disparity is likely to close.

Businesses in the US and around the world face the challenge not only of adjusting to the new tariffs that have been imposed, but of managing uncertainty in what is set to be a complex and unpredictable situation for the foreseeable future.

The Wood Mackenzie view

Wood Mackenzie researchers and consultants have been busy working with clients to help them understand the impacts of actual and potential future tariffs, and to manage the consequences for their businesses. A summary of some of our key market insights can be found on WoodMac.com. with much more detail available for clients.

These are some of the key conclusions from the events of the past week.

Steel tariffs threaten cost pressure for the oil and gas industry

When the first Trump administration imposed 25% steel tariffs in 2018, there were significant exemptions for a number of countries’ exports of oil country tubular goods (OCTG): the pipes and tubes used by the oil and gas industry. This time around, President Trump’s words suggest exemptions will be harder to come by.

The US typically imports about 40% to 50% of its OCTG, says Nathan Nemeth, Wood Mackenzie’s principal analyst for global unconventional plays. So tighter tariff rules with fewer exemptions would likely have an impact on prices.

OCTGs represent about 8.5% of drilling and completion costs for onshore wells in the US Lower 48 states. So if prices rose by 25%, to reflect the tariff impact in full, about 2.1% would be added to well costs. Before the tariff announcement, Wood Mackenzie had been forecasting costs in 2025 would remain broadly unchanged from their levels in the fourth quarter of last year.

That impact from tariffs would be much smaller than the cost inflation seen at the end of the pandemic. OCTG prices roughly doubled between late 2020 and early 2023. But it would create an extra cost pressure on the industry at a time when companies were already planning for cautious growth in production.

The American Petroleum Institute has been making the case that President Trump’s energy agenda, aiming for strong growth in oil and gas production, requires tariff exemptions for OCTG.

Reciprocal tariff strategy implies significantly higher rates

Potentially, the biggest impact from President Trump’s “fair and reciprocal” tariff plan will come from treating other countries’ value-added tax (VAT) systems as equivalent to tariffs. President Trump said on his Truth Social platform over the weekend: “For purposes of this United States Policy, we will consider Countries that use the VAT System, which is far more punitive than a Tariff, to be similar to that of a Tariff.”

The implications of that approach are profound. The great majority of countries in the world use some form of VAT, with rates up to 27%. Wood Mackenzie consultants calculate that the average VAT rate in trading partners of the US, weighted by GDP, is about 17%.

Raising tariffs to that level would imply a dramatic increase for the US. It most recently reported an average tariff rate of 3.4% to the World Trade Organization.

That steep an increase in tariffs would likely have significant macroeconomic impacts on inflation and growth. However, as of today, it remains uncertain how far and how fast these new tariffs could be imposed. Businesses will be moving to understand their supply chains more deeply, prepare their responses for the new impacts that might emerge and take pre-emptive action to strengthen resilience where possible.

In brief

The Trump administration has announced the details of the new National Energy Dominance Council at the White House. The council’s role will be to advise the president on strategies for boosting US energy production, with the aim of cutting red tape, increasing private sector investment and advancing innovation. It will be chaired by Doug Burgum, Secretary of the Interior, with energy secretary Chis Wright as vice chair. The other members will be cabinet and White House officials.

Lee Zeldin, the new administrator of the Environmental Protection Agency, said he had discovered about US$20 billion “parked” at Citibank to be spent on the Biden administration’s priorities, and called for the immediate return of the money. The funds were contracted for two programmes: the National Clean Investment Fund, or green bank, and the Clean Communities Investment Accelerator, both established to support investment in low-carbon technologies. The EPA’s attempt to claw back the funds could face “legal peril”, E&E News reported.

The US Supreme Court intends to hear a case over California’s right to set its own emissions standards for vehicles, denying the Trump administration’s request for a delay. California has the right under the Clean Air Act to set its own, more stringent, standards for vehicle emissions, unless it is “arbitrary and capricious” in setting those standards or does not need them to meet “compelling and extraordinary conditions”.

The state has used those standards to drive down vehicle emissions further than was required by US federal regulations, and to encourage electric vehicle adoption. Other states also have the right to use California’s standards, which many have chosen to do, with the result that those standards are a significant influence on the US vehicle industry, undermining the impact of federal regulations. For that reason, the Trump administration wants to block the waiver for California that allows it to differ from national standards.

The case that will be heard in the Supreme Court is over a Biden administration decision in 2022 to approve California’s standards. The EPA’s new leadership had been seeking more time to review that decision.

Other views

Uncertainty dominates the 2025 US power outlook – Chris Seiple, Sam Berman and Ben Hertz-Shargel

Proposed US tariffs could increase onshore wind costs by up to 7%

Energy transition outlook: EU – Lindsey Entwistle

Energy transition outlook: UK – Lindsey Entwistle and Zoé Sulmont

How public-private partnerships can accelerate the energy transition – Kian Akhavan

Rethinking load growth: Assessing the potential for integration of large flexible loads in US power systems – Tyler Norris and others (This study from Duke University’s Nicholas Institute for Energy, Environment & Sustainability has provoked a vigorous debate about how the US grid can add more large loads such as new data centres for artificial intelligence.)

Quote of the week

“If the transition is not just, it will not succeed, because the political economy will not allow it.”

Speaking at India Energy Week 2025, Hardeep Singh Puri, India’s energy minister, emphasised the importance of access to energy as the world moves to lower-carbon technologies. Narendra Modi, India’s prime minister, last week hailed Puri as “at the forefront of making India a hub for petroleum and natural gas related initiatives, which are very important in our quest for self-reliance”.

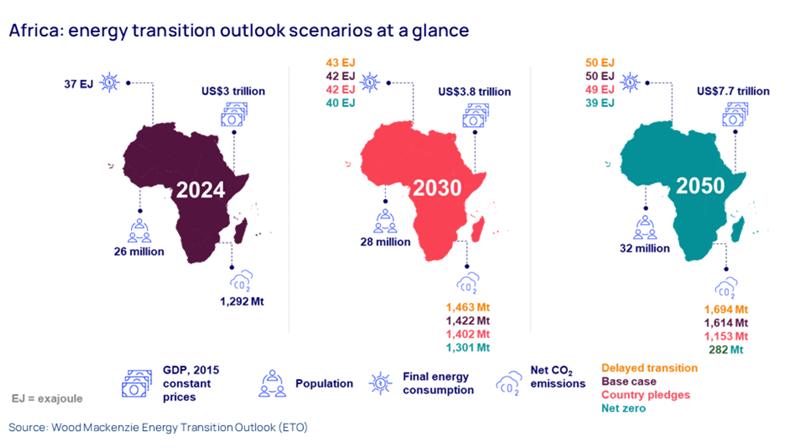

Chart of the week

This comes from our recent note on the energy transition in Africa. It shows the outlook for energy on the continent in five and 25 years’ time, in four different scenarios.

- 'Net zero' is a scenario consistent with a world that reaches net zero emissions by 2050.

- 'Country pledges' reflects the energy and climate commitments that countries have made, including their promised nationally determined contributions under the UN process.

- 'Base case' shows our view of the most likely outcome, as of last year.

- 'Delayed transition' shows a scenario with stronger headwinds delaying decarbonisation. Policy shifts since last year suggest we may be heading towards that delayed transition world.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.