Sign up today to get the best of our expert insight in your inbox.

What next for East Med gas?

Five key areas to unlock progress

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profileGavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

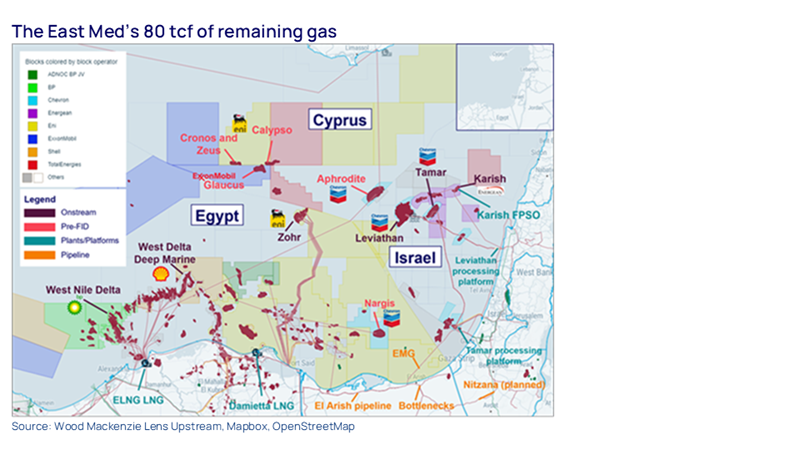

View Gavin Thompson's full profileThe Eastern Mediterranean (East Med) is a global gas hotspot, with Egypt, Israel and Cyprus at the heart of the action. Wood Mackenzie estimates the region holds some 80 tcf of advantaged remaining gas resources close to energy-hungry markets.

Despite having many of the ingredients for success, progress towards commercialisation has been stuttering. With Egypt experiencing a gas supply crunch, Israel looking for export growth and production in Cyprus yet to take off, accelerating development is a priority.

Gavin Thompson, Vice Chair EMEA, attended this week’s EGPYES event in Cairo and discusses five ways to deliver on the region’s gas potential.

First, strengthening collaboration between Egypt and Cyprus

Politically, the East Med is a tough neighbourhood. Competing national objectives too often hold back progress, while war in Gaza has curbed the pace of gas development. But the export deals announced this week between Egypt and Cyprus show an appetite for investment from both sellers and buyers of gas.

The energy crisis hit Egypt hard, with the country amassing multi-billion-dollar payment arrears to domestic gas producers that damaged credibility and curtailed much-needed upstream investment. A new Egyptian cabinet since June last year has set about restoring economic stability and investor confidence, paying down arrears with financial support from the IMF and key Gulf allies. But upstream producers still lament the unpredictable nature of ongoing receivables: on-time, consistent payments are essential to rebuilding investor confidence.

Progress is now being made in Cyprus more than a decade since the country’s first gas discovery. This week, Chevron reached an agreement for piped exports from its 3.5-tcf Aphrodite field to Egypt, while Eni signed a host government agreement with Cyprus and Egypt to develop the 2.5-tcf Cronos gas field and utilise Egypt’s Zohr infrastructure and Damietta LNG export terminal.

Second, revitalising Egyptian production

Egypt’s domestic gas production continues to decline steeply, with output down from 7 bcfd in 2022 to around 4.5 bcfd today. Zohr’s sharp decline, dwindling legacy production and lack of exploration success have led to an earlier-than-predicted gas deficit.

With payment arrears receding, exploration and development activity is slowly picking up. Development of key greenfield gas projects like Chevron’s Nargis and Shell’s near-field discoveries would go some way to meet growing gas demand, but much more is required. Last month’s play-opening multi-tcf Nefertari gas discovery on the offshore North Marakia block by ExxonMobil and partner Qatar Energy holds promise. But incentivising operators to develop new deepwater frontier acreage requires improved fiscal terms and higher domestic gas prices.

Third, diversifying Egyptian gas supply

With the era of mega-projects like Zohr and West Nile Delta largely over, Egypt must look more widely to source supply. More Israeli gas is an option. We assume Leviathan Phase 1B will leverage midstream expansion projects to meet increased regional demand, while Tamar gas exports to Egypt will also increase. Future gas imports from Cyprus now look more assured and further deals could follow.

Year-round Egyptian LNG imports seem set to be locked in. Egypt’s improved finances have helped with infrastructure deals, with two FSRUs secured and a third potentially in place this summer to meet peak demand. As a result, its LNG imports could rise by up to 6 Mt this year.

These moves underscore the permanence of Egypt’s gas deficit but don’t close the door on its regional gas hub ambitions. With massively under-utilised liquefaction infrastructure, Egypt could still attract more volumes, boosting hard currency inflows through re-exports into Europe.

Fourth, keeping the Majors engaged

The region is important to almost all the Majors and we estimate their remaining East Med NPV at US$19 billion. With the East Med set for significant growth through to the late 2020s, the Majors are its natural partners, attracted by stable cash flows from advantaged, low-emissions gas and potential access to European gas markets.

But this partnership shouldn’t be taken for granted. The region needs the Majors’ capital, technical expertise and execution. And while the East Med compares favourably to other regions in the Majors’ portfolios on some metrics, there is frustration at the more modest margins and domestic gas pricing, which doesn’t incentivise investment in higher risk/reward plays in deepwater and ultra-deepwater. Plus, it almost goes without saying, not getting paid doesn’t help, either.

Finally, attracting a wider range of investors

Newcomers are already starting to provide much-needed investment in Egypt’s gas sector. Arcius Energy, the ADNOC and BP gas-focused joint venture, is centred on Zohr, Atoll and exploration acreage in the Nile Delta and may also have designs on opportunities in Israel and Cyprus. The Carlyle Group’s acquisition of Energean’s Egyptian assets could boost its interest in local M&A, where opportunities are plentiful. We also expect Harbour Energy to keep its assets in Egypt, which ranks as the fifth-biggest country by NPV in a portfolio swelled by the Wintershall Dea merger.

Thanks to Martijn Murphy and Eimhear Sheehan from our MENA upstream research team.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.