Thank you for attending. We will be back later this year with the LME Forum on October 15 in London

Optimists had hoped that 2025 could be the year where positive economic momentum combined with loosening monetary policy to supercharge demand for metals. Unfortunately, things are rarely that simple.

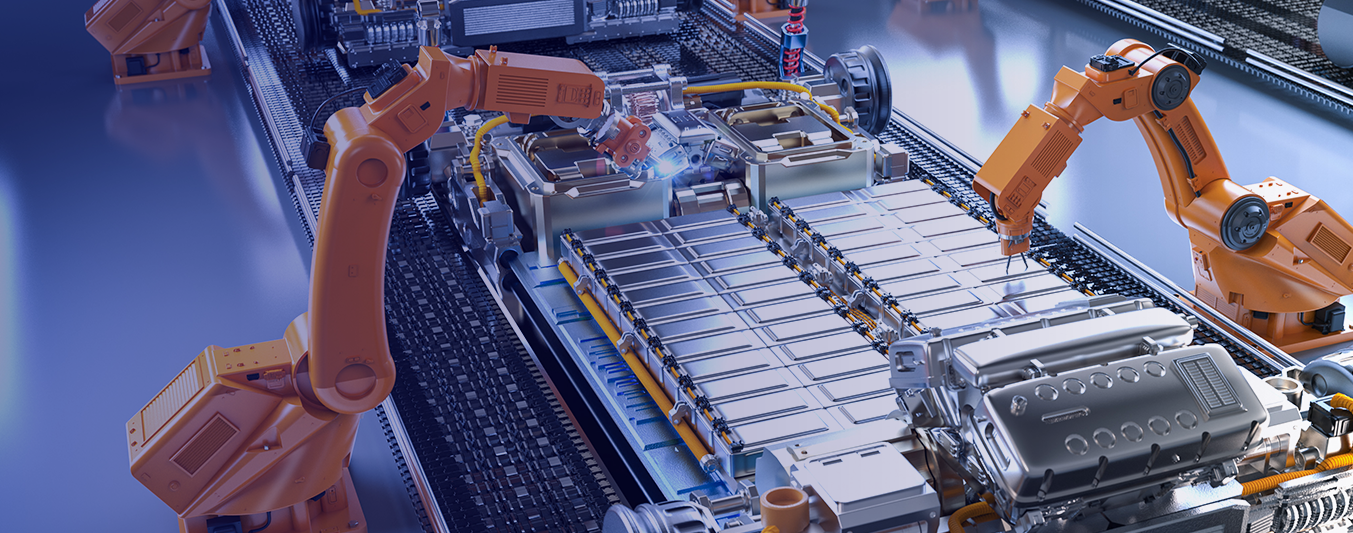

The outlook for metals was already complicated by deep concerns over China’s economic prospects. More worrying for metals investors was the broader deflationary effect of China’s processing capacity overhang in the EV, battery and renewables value chains. Trump 2.0 and his predilection for tariff diplomacy is now threatening to completely upend markets, stretching supply chains that were already under strain. Worse still perhaps, questions over delivery and longevity of US policy - and retaliatory measures - is transforming the risk around financial decisions.

To make sense of these seismic shifts, and their impact on the key commodities that underpin the energy transition, the Wood Mackenzie Future Facing Commodities Forum took place on 30 April 2025.

Topics that were discussed on 30 April:

- Metals markets: What has changed?

- Tariffs, trade and the energy transition

- Copper: Turning potential into growth

- Rare Earths: Unlocking their power

- Aluminium: Synchronising supply growth and emissions reductions

- Crunch time for the battery value chain

- Cathode & Anode: Waiting for recycling to make its mark

- Nickel: Looking for a route back to safety

- Lithium: How will the market rebalance?

2025 speakers included:

Robin Griffin

Vice President, Metals and Mining Research

An integral part of the research team since 2007, Robin leads our analysis across metals and mining markets.

View Robin Griffin's full profile

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex leads our growing long term and short term power research team in Asia Pacific

View Alex Whitworth's full profile

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

View Prakash Sharma's full profile

Emily Brugge

Senior Analyst, Copper Supply

Emily contributes to the Copper Markets and Copper Concentrates services.

View Emily Brugge's full profile

Bridget van Dorsten

Principal Analyst, Hydrogen

Bridget is a hydrogen-focused principal analyst on our Energy Transition Practice.

View Bridget van Dorsten's full profile

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne specialises in commodities including cathode and precursor, lithium, cobalt, graphite, rare earths and lead.

View Suzanne Shaw's full profile

Shashank Sriram

Senior Research Analyst, Aluminium Markets

Shanshank has 10 years of Aluminium industry experience within technical and management roles.

View Shashank Sriram's full profile

Prateek Biswas

Senior Research Analyst, Transport and Materials

Prateek specialises in EV policy drivers, automaker electrification strategies and battery supply chain trends.

View Prateek Biswas's full profile

Egor Prokhodtsev

Principal Research Analyst, Transportation & Mobility

Egor is a senior research analyst responsible for battery raw materials demand modelling.

View Egor Prokhodtsev's full profile

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi focuses on supply of global cathodes and precursors.

View Yingchi Yang's full profile

Sean Mulshaw

Research Director, Nickel Markets

Sean is an expert in global nickel, stainless steel and molybdenum markets.

View Sean Mulshaw's full profile