Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

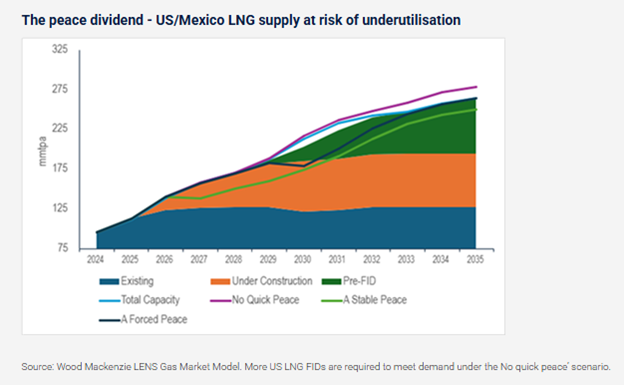

A “stable” Russia-Ukraine peace agreement could lead to years of US LNG under-utilisation and delays on US LNG FIDs

A “forced” peace agreement outcome, limits the upside for Russian gas

3 minute read

LONDON/HOUSTON/SINGAPORE, 08 April 2025 – As the geopolitical landscape of the Ukraine conflict enters a new and highly uncertain phase, Wood Mackenzie's Gas and LNG team has released a new report titled "What a future Ukraine peace deal means for energy". Using the Lens Gas Market Model the report outlines three peace agreement scenarios and explores their potential consequences in terms of sanctions and the implications on trade flows and prices.

“Energy will be a key part of the negotiation agenda of any peace deal. Removal of US sanctions on its LNG projects will be the very least of Russian demands as it looks to reaffirm its position as a global LNG player,” said Massimo Di-Odoardo, Vice President of Gas and LNG Research at Wood Mackenzie. “The EU holds the keys for a potential return of Russian gas to Europe, meaning a comprehensive and mutually acceptable peace agreement is a pre-condition for any meaningful return of Russian pipeline gas”.

- Scenario 1: No quick peace. A failure to reach any agreement cannot be ruled out and would results in "stronger for longer" gas prices as even less Russian supply comes to market. A continuation of the war could see the EU double down on sanctions, pushing even harder to achieve its ambition of independence from Russian energy - banning LNG imports from the Yamal LNG project and the 15 bcm a year TurkStream pipeline. This scenario strengthens the need for more LNG supply, with US and Qatar capitalising on more investment opportunities.

- Scenario 2: A forced peace.Based on the dynamics of negotiations at this early stage, a peace deal effectively forced on Ukraine by the US and Russia looks the more likely outcome, allowing for only a limited return of Russian piped gas and LNG into the market.

The US would be easing sanctions on Russian LNG exports to facilitate a deal, but a likely EU ban on Arctic LNG-2 would limit winter exports and curbs annual output at 6 Mtpa. Meanwhile, the EU is unlikely to wanting more exposure to Russian pipeline gas, although some additional flows into Hungary and Slovakia via Ukraine might be the price of keeping the bloc’s Moscow leaning members from vetoing on extension of EU sanctions on Russia. This limited return of Russian gas and LNG helps the market rebalance more quickly, paving the way for lower prices. Some US LNG projects in line for FID could face delay, but the overall impact on new LNG investments could be modest.

- Scenario 3: A stable peace. A scenario where all parties sign up to a comprehensive and mutually acceptable peace agreement would open the door to material volumes of Russian gas into Europe.

In this scenario, Europe could be looking to accommodate more Russian pipeline imports by up to 50 bcm a year. Meanwhile, the lifting of US sanctions on Russian LNG raises exports to 12 Mtpa. As a result, European (TTF) gas prices would collapse well below the US$8-9/mmbtu that we already anticipate in 2028/29, leading to years of US LNG capacity underutilisation and delays to several expected LNG FIDs. As a knock on to this, Henry Hub prices in the US soften in turn due to lower-than- expected LNG exports, supporting more gas into domestic power generation and helping lower prices for US consumers. But with an average of 25 Mtpa of capacity at risk of underutilisation over the next five years, US LNG would be the collateral damage.

Di-Odoardo added, "The outcome of ongoing negotiations for a peace agreement between Russia and Ukraine remains highly uncertain. All scenarios are possible, including potential combinations of them, however, recent development suggest a peace agreement where the US and EU take different approaches to lifting sanctions, appears more likely."

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most.