Energy transition outlook: Asia Pacific

Low-carbon projects and policies progress, but face energy security and price stability concerns

2 minute read

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

View Prakash Sharma's full profileRoshna N

Research Analyst, Energy Transition

Roshna N

Research Analyst, Energy Transition

Roshna N specialises in integrated energy and emission models for Asia-Pacific and African markets.

View Roshna N's full profileJom Madan

Senior Research Analyst, Scenarios & Technologies

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom works on scenario modelling for country and global-level energy mixes across all major energy commodities

View Jom Madan 's full profileAsia Pacific comprises 50% of the world's population and contributes a third of its GDP. Its share of energy demand and emissions remains broadly unchanged at 50% and 60%, respectively, between now and 2050.

Decarbonisation is a common theme across the region, but the opportunities, challenges and risks associated with it are not distributed evenly. Varying levels of wealth, hydrocarbon reserves, political realities and renewables potential have transformed the region into a kaleidoscope of unique circumstances where every technology has a role to play.

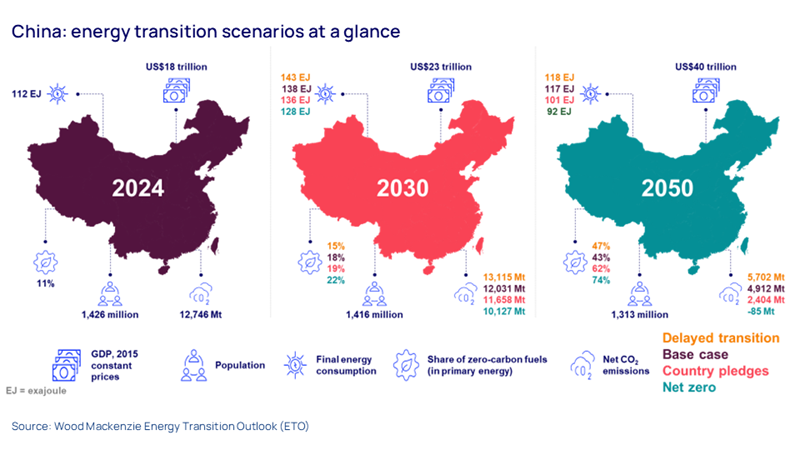

Our energy transition outlook (ETO), part of our Energy Transition Service, maps four different routes through the global energy transition with increasing levels of ambition. And our regional updates delve into the detail at country-level. The Asia Pacific report considers pathways for nine major markets: Australia, China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Vietnam.

You can access a complimentary extract from the Asia Pacific 2025 update by filling in the form at the top of this page. And read on for an introduction to some of the key themes.

APAC countries advanced energy transition policies and projects in 2024…

Progress was made in a number of areas. Including:

- Clearer CCUS policies: countries in the Asia Pacific with high CO₂ storage potential – Indonesia, Malaysia and Australia – enhanced policy and regulatory frameworks.

- Stronger collaboration: Japan and South Korea solidified their roles as key facilitators of hydrogen and CCUS adoption in the region. They advanced cross-border CCUS projects involving Australia and Malaysia and fostered hydrogen offtake agreements, such as those between Japan and India.

- Breakthrough projects and policies: including Japan’s landmark trial voyage with the world's first low-temperature and low-pressure liquefied CO₂ carrier, India’s FID for a 1 Mtpa green ammonia project and South Korea’s launch of the world’s first clean hydrogen bidding mechanism for power sector applications.

- Fast-tracked solar installations and EV adoption: China installed 292 GW of solar capacity in 2024, up from 257 GW in 2023. EV sales in China also surged to a record percentage of total vehicle sales in 2024.

...but many still prioritise fossil fuels for energy security and economic growth

Energy security concerns drove increased coal capacity in key Asian markets in 2024. India added 4 GW of new coal power, consistent with 2023, and plans to expand coal capacity by 90 GW by 2032 to meet rising electricity demand.

Despite pledging to halt new coal projects after 2023, Indonesia proposed additional coal plants and expanded its captive coal fleet to support its growing metals industry.

Meanwhile, China stepped back from its 2025 energy efficiency target under the 14th Five-Year Plan, having achieved only a 2% decline in energy intensity between 2020 and 2023, far below the 13.5% target.

Renewable energy targets also faced setbacks. South Korea shifting focus to nuclear energy and increased reliance on fossil fuels. Similarly, Japan’s coal-based generation remained steady, and its renewable energy share is now projected to reach only 32% by 2030, falling short of its Strategic Energy Plan (SEP) target.

How has all of this altered the energy transition outlook for Asia Pacific?

Our 2025 update explores the role different Asian markets play in achieving the Paris Agreement goals and the latest outlook for commodity demand, power supply mix and end-use energy demand under our four energy transition scenarios.

Our complimentary extract includes forecasts for gas, oil, and coal demand, along with projections for new technologies such as electric vehicle stock, carbon capture and storage needs and hydrogen demand.