Energy transition outlook: Middle East

Energy transition progress slows in our latest update – but uncertainty around pace and duration pushes the Middle East to prioritise resiliency

2 minute read

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom works on scenario modelling for country and global-level energy mixes across all major energy commodities

Latest articles by Jom

-

Opinion

Energy transition outlook: Middle East

-

Opinion

Energy transition outlook: Asia Pacific

-

The Edge

The coming low carbon energy system disruptors

-

Opinion

How the MENA region and its NOCs are diversifying into new energies

-

Opinion

Bioenergy: a US$500 billion market opportunity

-

The Edge

How the world gets onto a 1.5 °C pathway

The Middle East’s energy transition journey will be a challenging one. The region produces around a third of the world’s oil supply. Fossil fuels generate much of its wealth, with hydrocarbon revenues for the largest producers accounting for between 30 and 60% of GDP for its largest producers and more than 80% of exports.

Building a new energy economy means accelerating nascent diversification efforts and pushing hard towards ambitious net zero goals. But successive shocks to global markets threaten climate progress in a decade pivotal to scaling up alternative energies. Against this backdrop, can the Middle East get on track to meet its pledged climate targets?

Our energy transition outlook (ETO), part of our Energy Transition Service, maps four different routes through the global energy transition with increasing levels of ambition. And our regional updates – updated for 2025 – delve into the detail at country-level.

You can access a complimentary extract from the Middle East report by filling in the form at the top of this page. And read on for an introduction to a few of the key themes.

Middle East energy transition ambitions are under pressure

Decarbonisation progress so far has been insufficient to meet the ambitious climate goals set out by many countries in the Middle East region.

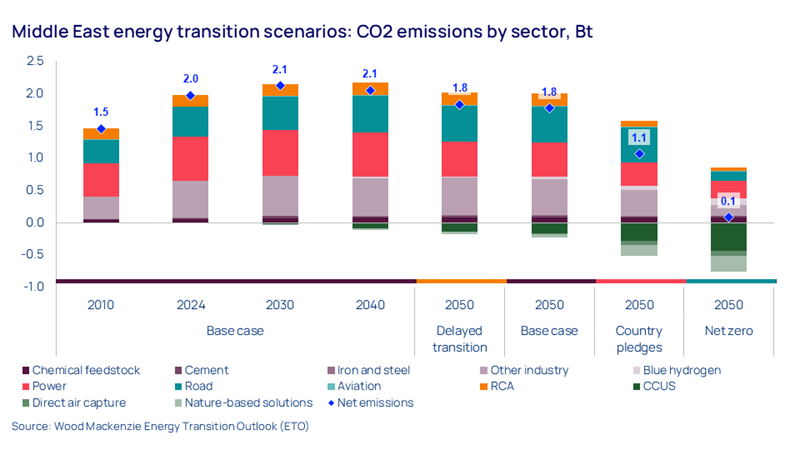

In our base case, we expect emissions to remain at roughly their current levels through until 2050. Despite a massive renewable energy rollout, abatement in the power sector is offset by petrochemical industry expansion and a 52% growth in vehicle stock by 2050 with only 7% electric vehicle (EV) adoption.

Commercialising low-carbon fuels supply is a critical to Middle East decarbonisation strategies

The Middle East’s oil and gas reserves have resulted in especially low domestic energy prices, with little financial incentive to transition. The region’s energy mix consists of 97% hydrocarbons today, with the share of renewables expected to grow to just 16% by 2050.

Renewable energy, carbon capture and low-carbon hydrogen are all crucial to address the region’s emissions. Kickstarting development hinges on commercialising exports of low-carbon commodities. Advantaged resources and established infrastructure will allow adjacent industries to participate, enabling abatement across the wider economy. But it remains to be seen whether other markets can accept the prices offered.

Could the pendulum swing back?

Global liquids demand peaks at 106 mb/d in 2030 in our base case. But with the US oil and gas industry poised for expansion under President Trump and slowing EV adoption in developed markets, liquids demand looks set to sustain longer and peak higher. However, structural risks to fossil fuel demand remain the same, so the real question is whether or not this new momentum for hydrocarbons will last.

Uncertainty brings with it the risk of oversupply. Middle Eastern producers will be focusing on greater resiliency through advantaged assets and petrochemical integration while laying the groundwork for low-carbon fuels production.

Get a closer look at the Middle East’s energy transition scenarios

The full report – updated for 2025 – sets out our commodity and power outlooks across our base case, and three energy transition scenarios: delayed transition, country pledges and net zero by 2050.

The report explores:

- The increasing likelihood of a delayed transition with sustained oil demand

- The outlook for renewables, hydrogen and carbon capture in the Middle East

- How the region could get back on track to meet its pledged climate targets

- Country-level deep dives for Saudi Arabia, Oman and the UAE.