Could renewables be the Majors' next big thing?

This report is currently unavailable

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

- Executive summary

- The Majors need a piece of the action in renewables

-

Large-scale investment needed to grow a meaningful position

- Renewables value proposition is competitive

- Returns versus upstream options

- Cash flow visibility is a key attraction

- Scale is a challenge – offshore wind is one answer

- Renewables strategies will be polarised but increasingly prominent

- Five key factors that will influence strategies

- Early adopters will have structurally different portfolios by 2035

- Appendix

Tables and charts

This report includes the following images and tables:

- Total primary energy demand growth from 2015 to 2035

- Renewables power market growth, 2015 to 2035

- Evolution of real revenues from renewables and global oil and gas (base case and carbon constrained scenario)

- Production profile for Majors if renewables' market share matches oil and gas by 2035

- Capex needed for renewables' market share to match oil and gas by 2035

- Cash flow from scaled-up offshore wind vs large upstream growth projects

- Cash flow from scaled-up solar PV and onshore wind vs medium-sized upstream growth projects

- Main assumptions by project

- Comparison of wind, solar and upstream IRRs*

- Cash flow from base-case wind and solar projects

What's included

This report contains:

Why buy this report?

The transition to new energy marks the biggest shift in strategic direction in a generation. The growth opportunity in renewables cannot be ignored. Use our analysis to:

- Understand how the Majors are repositioning portfolios as the case for renewables becomes compelling

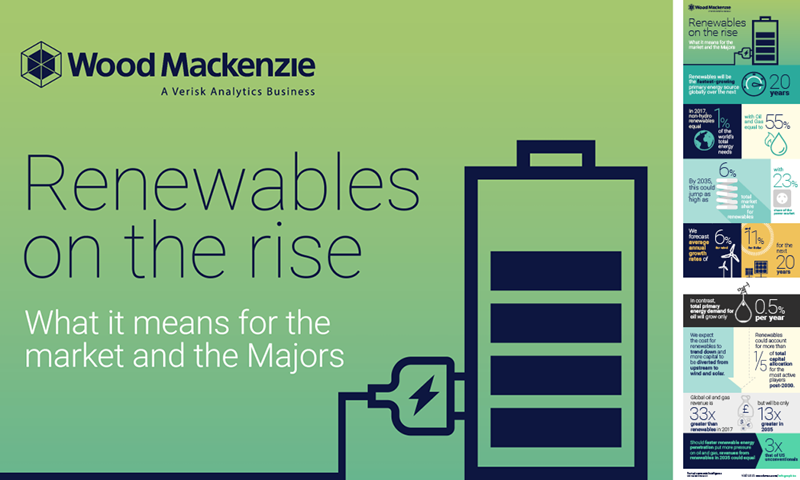

- Identify the scale of the opportunity for renewables, expected to be the fastest-growing primary energy source globally over the next 20 years

- Make informed capital allocation decisions by comparing renewable energy against upstream returns

We have invested heavily to build a strong competency in alternative power and renewables.

Our report offers an expert view of the factors that will influence the Major's investment decisions as they seek to take advantage of growing renewable energy demand. It includes:

- Data tracking growth in the renewables market over 20 years

- Forecasts for how real revenues will evolve from renewables, and shift away from global oil and gas

- Detailed power project economics, based on market geography and plant type

- Cost comparison of wind and solar against upstream projects, to compare and contrast opportunities

Other reports you may be interested in

Recycled Polyolefins: The Emergence of the Pyrolysis Industry

From waste into resource, how recycling polyolefins is the next big thing

$900Upstream licensing round quarterly: Latin America continues winning streak

Highest ever signature bonus paid for a Concession block in Brazil's Round 15.

$1,300Corporate week in brief: China's CEFC buys US$9 billion stake in Rosneft

We look at one of the largest overseas oil and gas acquisitions by a private Chinese company and Statoil's latest business development.

$700